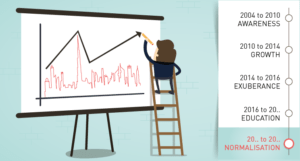

Once upon a time: Trade Credit Insurance in Dubai – Episode 6: Normalisation

After the education period, we will reach the normalisation phase, where market penetration will be much higher and it will be the right time to introduce more complexity into the trade credit insurance industry in Dubai and across the region. You can introduce complexity in the trade credit insurance industry via two paths: through launching more complex products and enhancing the partnership between credit insurers and local banks.

From short term to long term guaranties

First, credit insurers will offer a broader range of products comparable to those which are already available in Europe. Basically, today, trade credit insurance covers short term accounts receivable of policy holders which should not be more than 180 days. In the future, they will cover medium to long term risk by introducing products such as transaction covers, single risk cover or surety. It is more complex as credit insurers have to grant coverage which is generally non-cancellable on the obligor for a longer time from 1 to 5 years and is therefore riskier. It requires specific risk underwriters who do not just look at the balance sheet of the obligor but who take into account the political risk within a specific industry as well.

Efficient partnership between trade credit insurers and bankers

Secondly, better partnerships between banks and credit insurers will enhance the use of this product among businesses. If it is explained properly by credit insurance actors and duly understood by local bankers, trade credit insurance can participate in boosting the economic activity of the region. Bankers will use trade credit insurance to lend more working capital to large corporates and SMEs which will boost overall economic activity.

Furthermore, this partnership might be facilitated by the broad movement of digitalisation in each and every industry and the emergence of many “Fintechs”. For instance, Euler Hermes through its digital agency facilitated Urica, a Fintech in Europe, in accessing its database of businesses to lend working capital to SMEs. It will not be surprising to see Fintechs such as Urica coming to the Dubai market in the near future.

To conclude this series of articles, trade credit insurance was introduced in Dubai in 2004 and more than ten years later the industry is continuously evolving, enhancing and looking for more efficiency. It is thus tremendously exciting and interesting to participate in the development of the trade credit industry in a region such as the GCC.

Read the previous article here.