Decoding country risk

Credit insurers continuously adjust their country risk exposure depending on their assessment of the economic health of countries. In addition, they also cap their maximum credit exposure for sensitive countries, which is a common practice among banks. The main credit insurers have built up their own country grading matrix and others use international credit agencies such as Standard & Poor or Moody’s to name a few. It is interesting to notice that from one credit insurer to another, their view on some countries might differ, so let’s try to understand where these differences come from.

How does a credit insurer assess a country’s risk?

First, to build up their own model, credit insurers need data and most importantly reliable data. Obtaining reliable information is obviously much easier in mature markets where you have established statistics institutions whereas in emerging markets transparency is sometimes still a challenge (even if we have seen in the past during the financial crisis that data can be manipulated in a developed country such as Greece as well). On top of macroeconomic information such as GDP, inflation, debt levels etc, credit insurers also use in house figures to fine-tune their assessment. They can look at the payment experience of their clients which is basically the amount of overdue and claims reported by policyholders. This gives them an edge compared to credit rating agencies as such information is an advanced indicator of the economic health of a specific country. They can foresee if a specific economic sector is starting to suffer by looking at the payment terms between suppliers and buyers; if payment terms are lengthening, it is typically a negative economic indicator.

In addition, credit insurers are increasingly trying to integrate big data and artificial intelligence into their economic matrix even if we are still in the early stages of this. In any case, the more data you have, the more accurate your rating model will tend to be.

Measuring the country risk differences between credit insurers with AU G-Grade

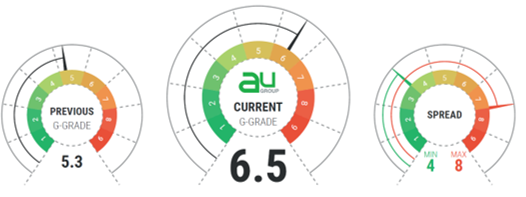

Even if all credit insurers share basically the same methodology to measure the level of risk in countries, we see that their assessment can sometimes differ. To measure these differences, AU Group has developed a unique approach to country risks, the “AU G-Grade”, released quarterly, which is a condensed overview based on the country risk assessments of the major credit insurers (Euler Hermes, Atradius, Coface & Credendo). AU G- Grade evaluates a country risk on a scale from 1 to 10, with 1 being low risk and 10 being high risk.

We compare the country rating of each of the credit insurers and we also provide basic macro-economic data such as the unemployment rate, GDP, inflation etc. You can see the summary of the rating scales shown for each country below. Of course, the most interesting information is the spread scale which highlights the gap that exists between credit insurers.

As explained previously credit insurers do not just use macroeconomics data but in-house figures as well, hence depending on their local presence or their level of exposure in a given region, they can be more or less precise in their assessment. For instance, credit insurers such as Coface or Credendo have a better understanding of the African market compared to others due to a long-standing presence and a higher level of exposure. In other regions, Atradius, Euler Hermes or others will be better. Finally, their assessment might have a bias sometimes as well, depending on their development strategy in a given region.

Depending on the region, credit insurers are more or less strong and accurate in their risk assessments. Therefore, it might be challenging for clients who operate globally to just rely on one insurer to insure their accounts receivable. It can be more efficient to work with several credit insurers to take the best of what they can offer depending on their local strengths. A tool such as AU G-Grade helps clients to select the best credit insurer for a given country.