End of the recession but an uncertain future

2017 marks the end of a strong three-year recessionary cycle, with a total contraction in GDP of 7% in 2015 and 2016, and marginal growth of 0.8% forecast for this year.

Two resulting positive effects: inflation controlled at 5% and bank lending rates, among the highest in the world, starting to come down–spread of around 5% deflated.

The political environment remains problematic, and the 2018 outlook unclear.

The adoption of reforms necessary for the country’s competitiveness–employment and retirement law, with Brazil having one of the most generous systems in the world–has been blocked since the involvement of President Michel Temer in one of the numerous corruption scandals affecting the country’s credibility.

The climate of uncertainty is expected to last at least until the October 2018 presidential election.

INSOLVENCY: DEVELOPMENT AND TRENDS

In 2005, Brazil established a process known as ‘’Recuperação Judicial’’–equivalent to Chapter XI in the US–which aimed to grant a moratorium to companies in difficulty to reduce their debt and avoid bankruptcy – Chapter VII.

A change to the system’s rules intended to improve creditors’ position is being considered.

With a sharp rise in the number of bankruptcy protection filings over the last two years, the trend reversed in 2017:

2016: +125% compared with 2014

2017: total over 10 months fall of 25% on 2016 (y/y)

Less marked downtrend in 2017 in bankruptcies

2016: 12% compared with 2014

2017 from January to October – 4.4% (y/y)

Having begun, the downtrend is expected to consolidate given the economic projections of a recovery and further cuts expected in the Brazilian benchmark interest rate.

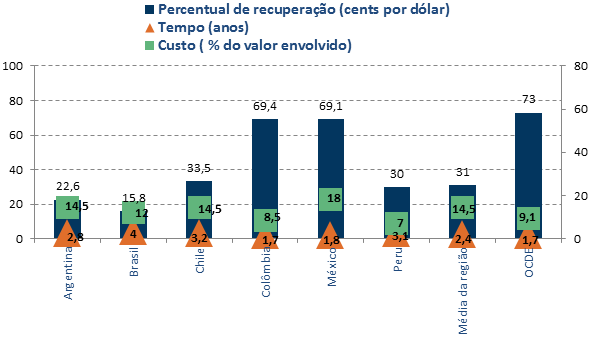

International Comparative Study on Corporate Insolvency Published by the World Bank (Source Doing business index)

Top Line – Percentage of Recovery

Second Line – Time (years)

Third line – Cost (%age of value involved)

Compared to the OECD average, where 73% of debts are recovered after 1.7 years at a cost of 9.1% of the securities in question, Brazil occupies a very unenviable position: only 15.8% of the debt is recovered at the end of 4 years but with a recovery cost of 12%

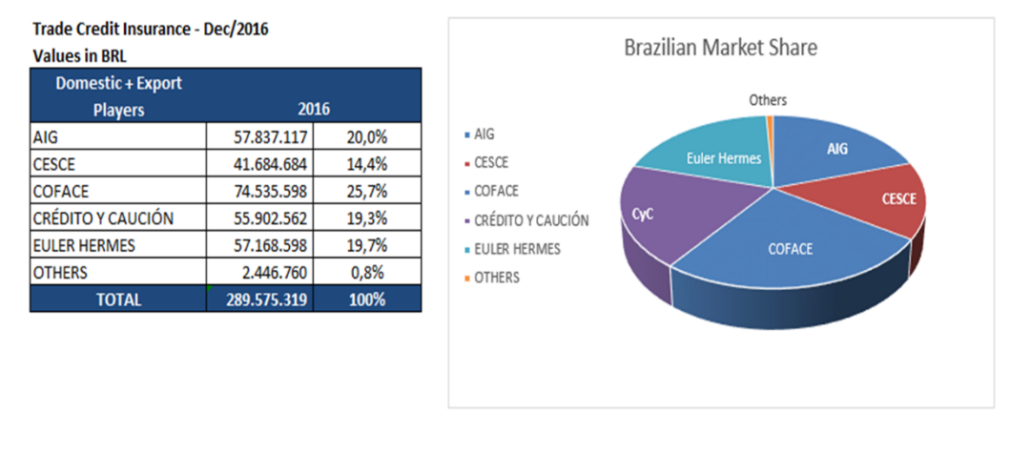

POSITIONING OF CREDIT INSURERS SITUATED IN BRAZIL

ACE, Chubb, QBE and recently Markel are trying to position themselves through a local licence.

AIG recently made a strong breakthrough with its Excess of loss offer, which constitutes a welcome alternative to the traditional ground-up formulas of specialist insurers.

The bulk of premium volumes is generated by the Brazilian subsidiaries of multinationals, particularly European. Brazilian companies are, however, showing a growing interest in the domestic and export markets.

There has also been a rise in demand relating to the crisis, and the offer is expected to improve as we emerge from the crisis.

About A.U. Group Brasil

A.U. Group Brasil has been authorised to operate in Brazil since mid-2014.

The local team has considerable experience in the Brazilian credit insurance market, and supports every A.U. Group client in structuring credit insurance solutions and in daily dealings with insurers.

As well as providing information and training to managers on contractual issues, A.U. Group Brasil frequently acts to obtain from insurers enhancements to the authorisations of strategic buyers. It provides essential support in a complex economic environment.