French and German savers: the unequal twins

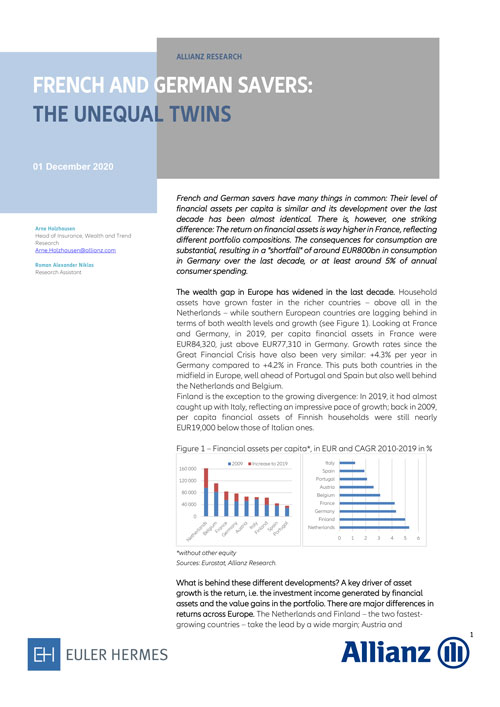

French and German savers have many things in common: Their level of financial assets per capita is similar and its development over the last decade has been almost identical. There is, however, one striking difference: The return on financial assets is way higher in France, reflecting different portfolio compositions. The consequences for consumption are substantial, resulting in a “shortfall” of around EUR800bn in consumption in Germany over the last decade, or at least around 5% of annual consumer spending.

Please fill in this form to download the publications.